Heard about the $50 challenge??

In Jamaica, we have the sayings that “every mickle mek a muckle”, as well as “one one cocoa full basket”. Simply put, it means that every little thing eventually adds up. One drop of water becomes an ocean by scale. But if this is true and this is something we believe in, why do we have a disdain for things that we think to be too small. Should money be considered such? You know…too small?

I have seen many people leave coins behind at counters, disregard them when they fell from their hands or bags and I have even witnessed windscreen wipers throw away coins. “Afta mi nuh waa nuh red money or small change. Weh dis can do?”

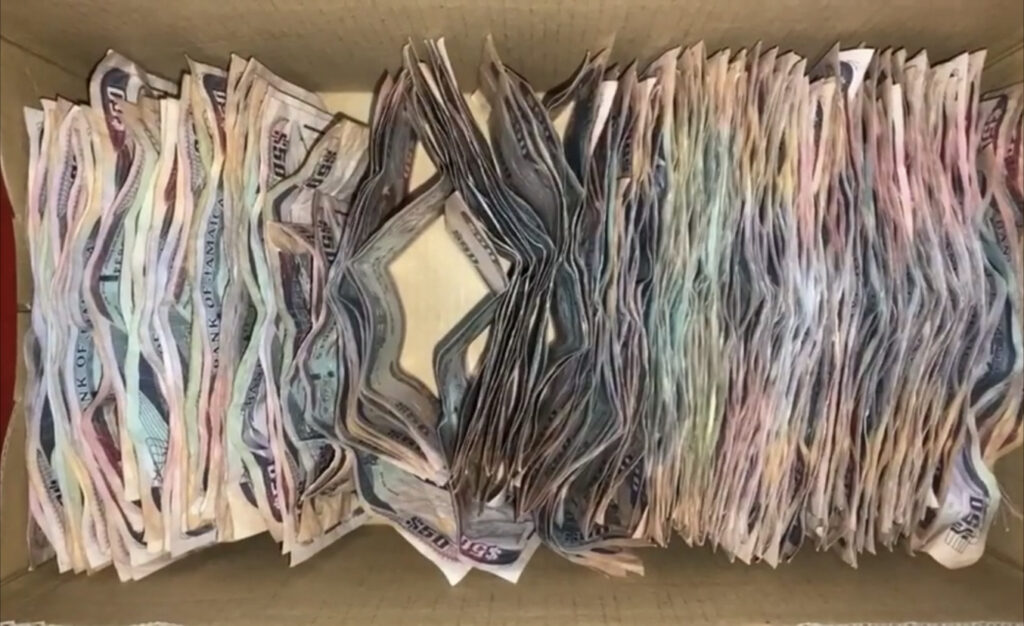

Before I start, I apologise to the Bank of Jamaica if they experienced a shortage of $50 notes, as well as the spouses who told me that their wives were accosting them of the $50 notes from their wallets LOL

At the beginning of 2020, I shared with my instafamily that Naima and I would try to save every $50 JMD (Jamaican Dollars) that came into our possession- not weekly, monthly or quarterly, but rather EVERY TIME we got it back as change. $50 is so insignificant right? You would be surprised! As much as I typically don’t handle cash, I realised that whenever I used cash and broke larger bills like $1000 or $5000, the change just disappeared-POOF…vanished! I would buy a soda here or there, purchase a snack and before I knew it, my cash was gone with nothing to show for it. What’s worse is that it never felt like I was spending a lot, because it was just $50. But the question is, how much could I potentially save in a year if every time, I got $50, I could save it? Well, let’s give it a try.

My daughter and I started and even though Covid came and disrupted our lives, many persons within the community stayed committed. It even extended to my online community members in the Jamaican Diaspora, region and all over the world. They simply did the equivalent in their currencies.

The rules of the $50 challenge were simple:

- Identify the bill we wanted to save (we decided $50 JMD) Foreigners decided to save $1-$5 (in their currency)

- Any participant was at liberty to increase the stakes. i.e. add coins or bills that had a higher value. e.g. My daughter and I eventually added $100 JMD

- We could start whenever with the goal of doing it until the end of the year. i.e. there were some of us who started in January and others came on later. The common goal was to stick it out till December 2020

- Do not count the money before December. What the mind doesn’t know the heart can’t take advantage of. LOL If you know how much money you are saving, the heart starts making a list go things it needs and wants.

- You are at liberty to do whatever you want with your savings at the end of the year.

- You could do the $50 challenge solo or with your partner or friends.

In spite of COVID-19, how did we do? Some were able to save $50 JMD consistently and understandably others had to divert funds in order to survive but all in all, people stuck to the challenge. As 2020 started to come to a close, a few members shared photos and videos of what they saved and I was flabbergasted! As we welcomed 2021, more members shared their dollar amount with us, expressed what they did with them and I couldn’t help but celebrate them.

What were some of the results? People opened their store-bought and make-shift piggy banks and counted their commitment. From $1,175 USD and $945 CND to $4000JMD, $60KJMD and 90K+ JMD 49k 54k, they showed up…but not for me….themselves!

Here is what I learnt from the $50 challenge and community:

1. The $50 Challenge takes Commitment

It was never really about the money but rather demonstrating that whatever that goal is takes self-discipline and commitment. It isn’t that we lack ambition and that we aren’t goal-oriented, but rather that we lack commitment. Achieving our goals requires ACTION. So many of us talk about things we want to achieve but eventually, we lose interest, can’t be bothered, lack commitment, and fail to complete the task. The $50 could very well represent any one goal (big or small) that you wanted to achieve. The real reward is that you didn’t make empty promises and you took one small intentional step that turned into many small intentional steps.

2. Not a Competition

Your goals, aspirations and execution are your own, nothing to compare to others. Many took part in the $50 challenge but it was never to compete against anyone. This initiative/challenge wasn’t about getting a trophy or medal for saving the most money. It was a revelation that each of us simply had to start with one small act and then follow it up. It was a personal decision and promise we made to ourselves. Some of us collected more than others but each person can feel proud of his/her accomplishments. For most of us, it was more than we did in the previous years. And certainly the first time, we had an actual savings plan. Participants eagerly shared that they were able to purchase that coffee table they needed, contribute to tuition, pay car insurance, home renovation. Others have invested it or banked it as a rollover. Each goal and achievement were just as valid as the others.

3. The $50 Challenge encouraged Collaboration

For those of us who lack self discipline, don’t be ashamed, that isn’t something easy to come by. It takes training and conditioning, lots of trial, error, a mindset/lifestyle shift or tremendous accountability partners. Sometimes, accomplishing a goal requires collaboration. An instafam member expressed that she did the $50 challenge along with friends. She counted $13,400 JMD, and her friends saved $12,500 and $7,500 respectively. Another revealed that she saved $85K, while her hubby saved $90K. A mother saved $21K and her son was able to save a smaller amount. This kind of support and teamwork create collaborative efforts and pockets of legacy that we don’t even consider. We are essentially sowing seeds not only into ourselves but helping others do the same and vice versa.

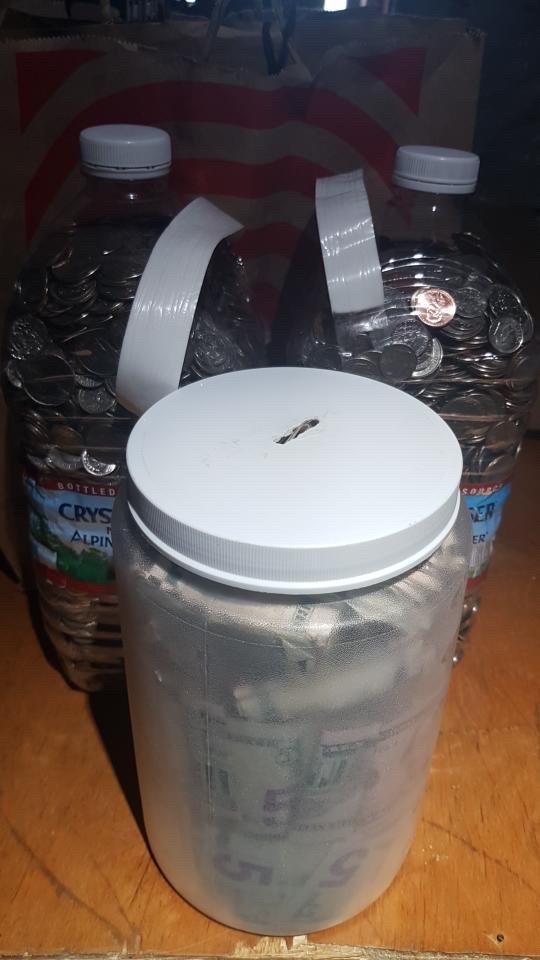

4. Creativity

We are all different, so are our goals and aspirations. It means that we won’t all approach the same task in the same way. A classic case of “where there is a will, there is a way”- some participants got empty gallon water bottles and created piggy banks. meant that they were willing to use what they had to get one step closer to their goal. Others took it a step further, they understood that based on their personalities, they had to not only seal their water bottle caps, but they also found ways of wrapping the bottles so that they wouldn’t be tempted by the sight of the money. When it comes to achieving goals, sometimes we can’t look at what works for others, we have to create ways that work best for ourselves.

6. COVID-19

The big fat elephant in the 2020 room was the novel Coronavirus. Some members weren’t able to meet their goals because many lost their jobs, were furloughed, or had to take salary cuts. Many felt terrible that they had to borrow from what they already started saving. My thoughts to you are, life happens fast and your goals might have been interrupted, but how amazing it is that you were able to have access to a little disposable fund all because you started 2 months before. That’s a great example of preparing for the unexpected. Begs the question, “what if you hadn’t?”

I hope that 2021 will be kinder and more favourable to you

So how much did we (my daughter and I) save? A whopping $6000 JMD. LOL We visited Grace Kennedy Cambio in New Kingston to exchange her coins using their automated machines and then took all her cash and lodged it in her bank account. With school restarting face-to-face, inevitably, she will resume getting her lunch money that will create more saving opportunities. As for me, it’s been a great teaching and bonding lesson. My hope is that she will not only save money but respect it.

All the best with your financial journey, whether it’s a water bottle, old pan, store-bought piggy bank or the actual bank, pace yourself and know that you have an entire community rooting for you.

Thank you to everyone who shared their photos and videos. It was a motivating to see the participation

Feel free to share (in the comment section) how much you were able to save. And no worries, remember this is you celebrating your small or big wins.

Cheers,

T-K

I saved $5600 in $50 notes. I rarely use cash plus since March I didn’t go out much to spend or get change and it still added up. I banked the $5000 and kept the $600 to start off a next round. Also have over $10000 in coins but been saving that since the end of 2018.

Hi Terri-Karelle.

I heard about your $50 challenge and I decided to give it a try. I lost my job during the pandemic but I still managed to save a total of $10000 at the end of the year.

Plan on putting it towards my son’s future Education. Cant wait to see how much I save by the end of this year.

Ps. Your an inspiration

I heard about the challenge late but I was able to save $15,000 until I went on that ‘broke period pause’. But thanks for the initiative it was fun.

Hi Terri, I was able save 10550, it’s a little less than last year though.

I haven’t counted mine as yet. Will do soon. I don’t use a lot of cash but I think I did reasonably well. Job well done guys.